Account Aggregators (AA) – Democratising the data ownership

AA framework can transform MSME lending similarly to what UPI did for digital payment

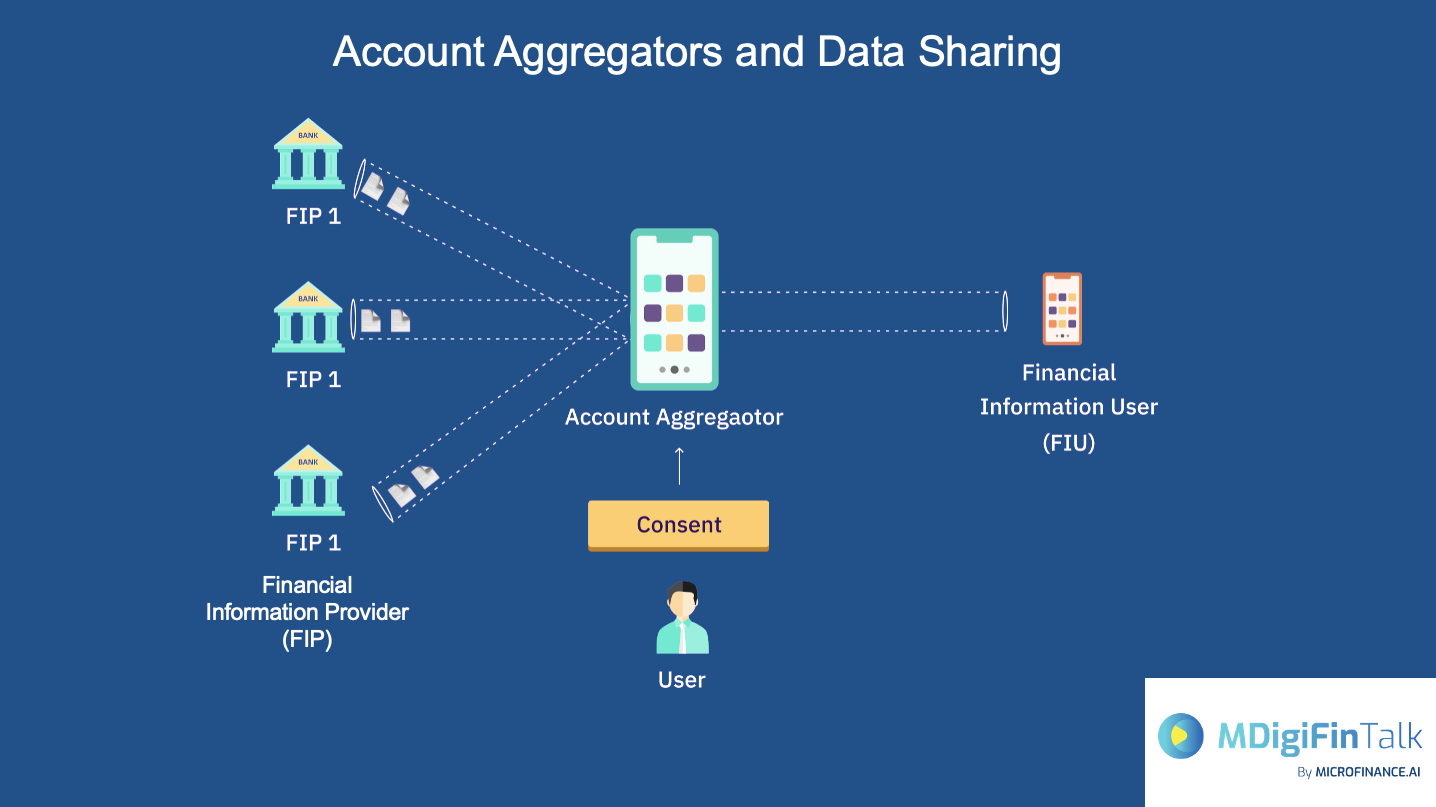

Account Aggregator Framework, an initiative led by RBI, is the latest step taken by the Government of India to make India future-ready to manage the data and its privacy.

Account Aggregator Framework hands over user data to the user, making the banks gather and maintain data into custodian. With the emerging digital economy, more and more bank accounts, loans, insurance, E-commerce transaction are taking place, leading to the creation of more and more user data. This control of this user data is currently is not with the user. This is the problem that the AA framework is trying to address.

In theory, the AA is built like the UPI apps. The client can connect all of his bank accounts, GST account etc., in the app. Every time a third party, say an insurance company or a loan provider, need access to the customer information like his/her transaction details, GSTIN info, account balance etc., they will send a request for the information accessible to the client AA app, which is then approved by the client who maintains control over the factors such as type of information provided and the duration of the access. Through this, the FIP and FIU could gain access to complete financial information of the client, which was not accessible to them before to customize products or to access the creditworthiness. Still, at the same time, it puts the customer in the driving seat on controlling and directing the data use. AA can help unlock $500Bn MSME lending and can be another game-changing initiative, AA Framework Can Do What UPI Did For Digital Payments

Both big companies and start-ups are emerging in this space

Mukesh Ambani’s Reliance Jio, Aditya Birla fintech company, has applied for an AA license

Startups such as Finvu, Onemany are also building their business model around AA.

AA also has the potential to grow beyond from being the aggregator of major data into a comprehensive aggregator of other non-traditional, alternative data such as utility payment, revenue tax on agricultural land, water bills etc., to cater to the next billion underserved segments in India, making not only credit accessible to them but also unbundling numerous sachet-size financial products such as micro-insurance and investment.

To gain more insights on this, kindly refer to the below,

“This can be as big as UPI” - Understanding the Big New thing in India tech

DEPA and Account Aggregators: The Future of Personal Data Sharing

Here’s how account aggregators share financial data of customers with bank

This week’s News

RBI proposes to lift interest rate cap on microfinance institutions

The Reserve Bank of India (RBI) on Monday proposed to lift the interest rate cap on microfinance institutions (MFIs) and said all microloans should be regulated by a common set of guidelines irrespective of who gives them.

Proposing a debt-income ratio cap, the RBI said the loans should be given in such a way that the payment of interest and repayment of principal for all outstanding loans of a household at any point of time should not cross 50 per cent of the household income.

Microfinance loan portfolio grew by 17% in FY2021

The gross loan portfolio of India’s microfinance sector grew 17% year-on-year (y-o-y) to Rs2.11 trillion, industry association Sa-Dhan said in a statement on Friday.

The 17% increase in the portfolio comes despite the sector having witnessed unprecedented times in the wake of the covid-19 pandemic, said P Satish, executive director, Sa-Dhan, an industry body comprising 225 microfinance institutions across India.

Axis Bank explores MFI stake buy to expand into rural India

Private sector lender Axis Bank is in talks with a few micro lenders including Arohan Financial Services, Satin Creditcare Network and Spandana Sphoorty Financial as it explores possible stake buy to expand into rural India, following the footsteps of IndusInd Bank and Kotak Mahindra which chose to improve their rural footprint through the acquisition route. `

IFSCA boosting Indian fintech start-up market

The International Financial Services Centers Authority (IFSCA) talks with 10 foreign jurisdictions for bilateral agreement to enable the Indian fintech start-ups to expand globally and provide access to foreign capital. IFSCA is also working on setting up the world's largest fintech hub at Gujarat International Finance Tec-City in Gandhinagar

ESAF small finance bank to use ML and AI in the day to day operations

ESAF small finance bank launched in March 2017 is planning to integrate Machine learning and Artificial intelligence to reduce their man-hours in various routine and basic activities say M.G Ajayan, EVP operations. For this purpose, ESAF is in talks with Oracle’s Autonomous Data Warehouse (ADW).

Jai Kisan raises 30 Million USD in funding from Mirae Asset

Jai Kisan, a rural Fintech startup has raised 217 crores in form of equity and debt funding from Mirae Asset. According to Jai Kisan, this funding will be used for growth expansion and enhancing data science and engineering capabilities.