Fintech and marginal farmers!

Many Fintech companies are working towards providing financial inclusivity to the marginal farmers by making digital innovation in bridging the geographical gaps, access to financial products etc., In a country like India where farmers are spread across the nation accounting for more than 65% of the population, access to credit is a serious problem.

The traditional credit providers to these marginal problems are faced with the below barriers in providing a justifiable financial product,

The Cost of operation runs high due to the cost involved in reaching the thinly spread marginal farmers

The lack of data to analyze the repayment capability of the farmers

The Risk involved is due to the unpredictability in the nature of income of the farmers.

So, high operating cost, lack of data and risk management seems to be the major challenges for the financial providers involved in this domain who uses their traditional means of credit.

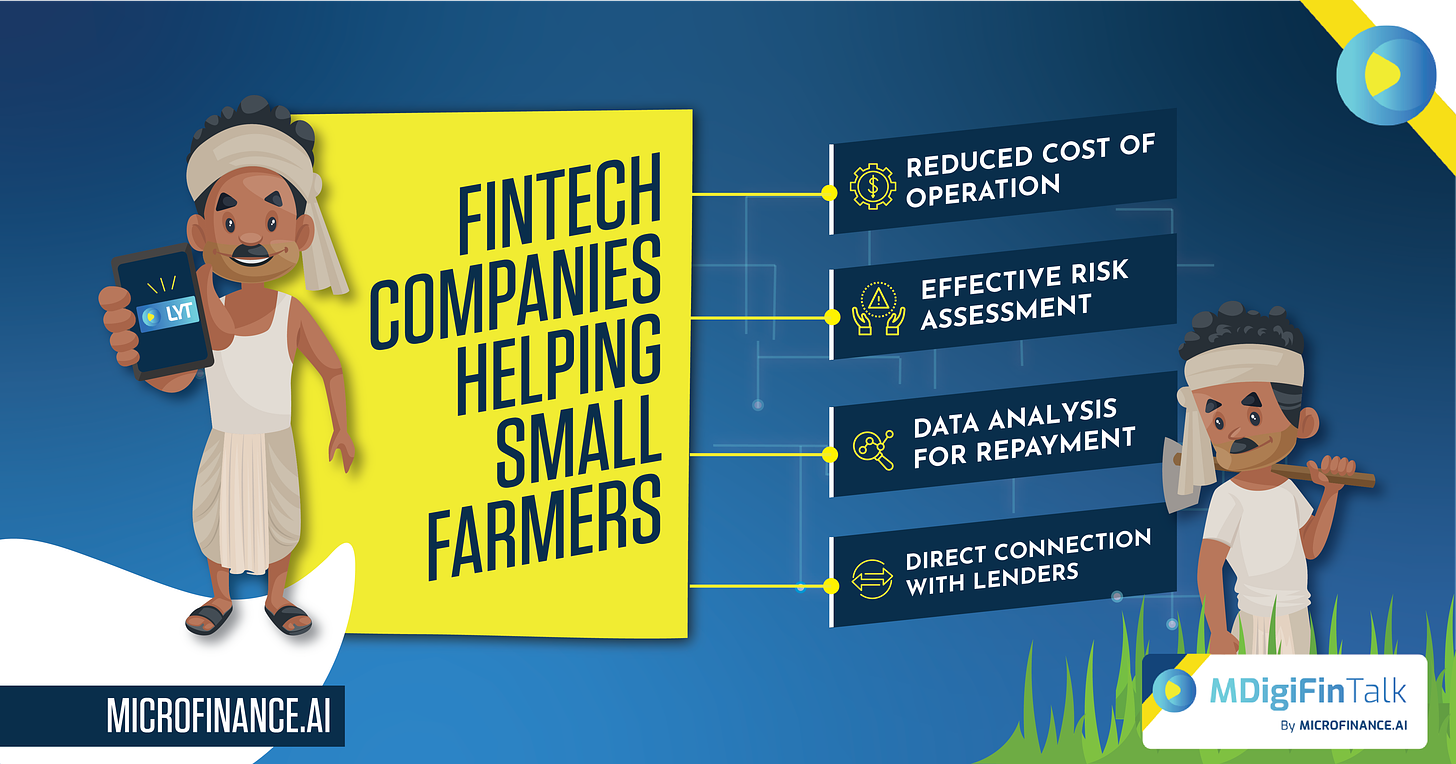

The Fintech companies address these exact problems through digital means. They use technology such as customer-centric mobile applications, scoring models, Field officer planning apps, online repayment etc., to overcome these barriers.

With these fintech companies, the financial service providers have better data, requires less manpower and can effectively use their field officers through online plans. They can develop customized products to cater for these marginal farmers due to this technology which enables them to access proper data and increase reach to the farmers.

This fintech helps in digitalizing the credit market greatly benefiting both the credit providers and marginal farmers.

You can read more on this through the below links,

With support from fintech, farmers can grow an inclusive global recovery

How fintech is helping small-scale farmers become profitable producers

Agtechs and financial institutions: Financing farmers in India

If you’re working with farmers groups such as producer organizations, community institutions and want to launch lending-as-a-services, reach out to us and we’ll help us to make lending business completely digital and efficiently.

This Week’s News

Aid sought to shore up MSME sector in TN

KV Kanakambaram, President of The Industrial Estate Manufacturers Association, said that 98 per cent of Indian MSME’s, including those in Tamil Nadu, are functioning on loans and cash credits borrowed from public, private sector banks, and Non-Banking Financial Companies (NBFCs), which also provided ‘Covid’ loans.

“Now, the issue is that neither the Union finance ministry nor the Reserve Bank of India consider the fact that such timely financial assistance has not been backed by the common sense of providing extension of the existing repayment tenure and relaxation of Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act, (SARFAESI Act) 2002, from demoting Covid lockdown impacted units as a Non-Performing Asset (NPA),” said Kanakambaram.

NFDB signs pact with PNB to extend financial assistance

National Fisheries Development Board (NFDB) under Ministry of Fisheries, Animal Husbandry & Dairying, Government of India has today entered into an MoU with Punjab National Bank, the premier Bank in the country, to extend financial assistance through the Bank.

Speaking on the occasion, Dr Suvarna, IFS Chief Executive, NFDB, said, “MoU with PNB will harness the untapped potential of Fisheries sector in tying up the individuals/Private Entrepreneurs of both FIDF and Entrepreneur Models under Pradhan Mantri Matsya Sampada Yojana (PMMSY) for availing Bank loan from PNB, pan India.

Collection efficiencies in securitised pools originated by NBFCs, HFCs improve in June: Icra

Domestic rating agency Icra Ratings on Thursday said the monthly collection efficiencies of its rated securitized retail pools originated by NBFCs and HFCs for June 2021 increased by 7-10 per cent over the previous month. The collections in July have continued to maintain an upward trajectory, the agency said in a report.

Asset quality pressure to persist for NBFCs

The pressure on the quality of assets for non-banking financial companies (NBFCs) would persist in the near term and the risk to this sector would remain elevated due to the impact of the COVID-19 second wave, ICRA said in a report.

Sa-Dhan proposes Rs 2 lakh income limit for both rural, urban households under MFI regulations

Sa-Dhan, one of the leading industry associations of microlenders, has recommended to the Reserve Bank of India (RBI) to keep the income limit of both rural and urban households at Rs 2 lakh per annum to be identified as microfinance customers. It also called for bringing all microfinance institutions (MFIs) under microfinance regulations among other things.

Fusion Microfinance files IPO papers with Sebi

Microlender Fusion Microfinance, which is backed by global private equity major Warburg Pincus, has filed preliminary papers with markets regulator Sebi to raise funds through an initial share sale.

The initial public offer (IPO) comprises fresh issuance of equity shares worth Rs 600 crore and an offer of sale of 21,966,841 equity shares by promoters and existing shareholders, draft red herring prospectus (DRHP) filed with Sebi showed.